Our new Investment is Iondrive (ASX: ION)

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 26,785,000 ION shares at the time of publishing this article. The Company has been engaged by ION to share our commentary on the progress of our Investment in ION over time.

Today we are adding Iondrive (ASX:ION) to our Portfolio.

The battery recycling market is forecast to grow to $100B by 2040.

ION’s battery recycling technology is cleaner, greener, cheaper recycling using Deep Eutectic Solvents (we will explain what that is later).

...and extracts the critical metals out of old batteries for re-use at high recovery rates - which can be sold back to battery makers.

The EU is moving to ban export of its old batteries for recycling, but needs to urgently grow its local recycling capabilities.

The EU and US have both set minimums on recycled metals content in its batteries.

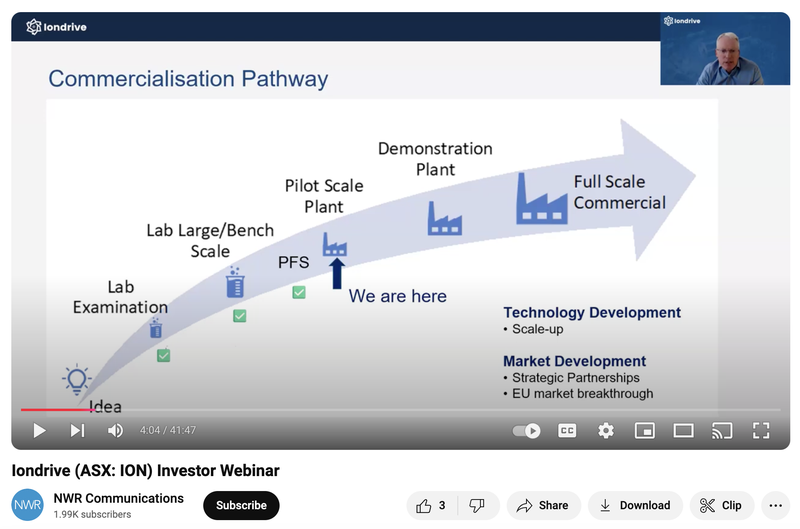

ION has already proven its battery recycling technology at lab scale. It is now planning to build a pilot plant to prove it can be scaled up.

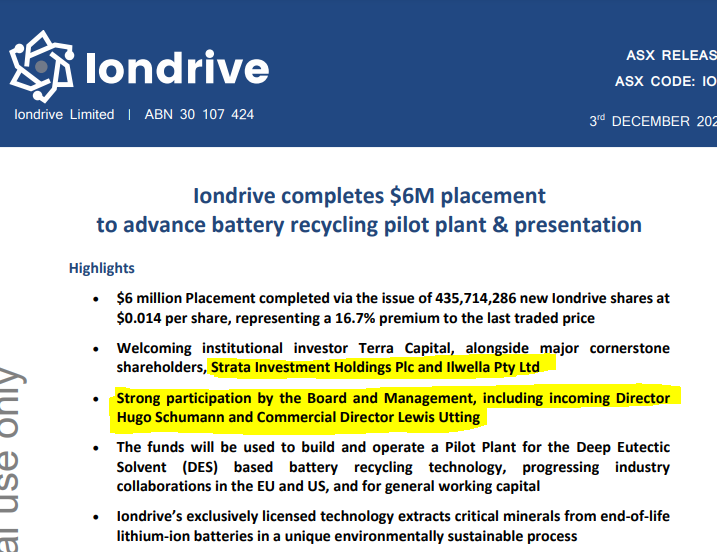

ION just raised $6M with backing from serious institutions, including the billionaire Flannery family investment vehicle.

With board and management putting in $380k of their own cash - this includes from two new key directors who came into this round after doing their own DD on the company and its technology (more on those guys further down).

Post capital raise ION will be capped at just $16M with a ~ $7M Enterprise Value.

Like all early stage tech investing, there are risks here, however we like the upside IF ION can successfully commercialise its technology over the coming years.

ION is targeting construction of a pilot plant in Europe early next year, with longer term plans to grow the business into the US as well.

We have previously had a win in innovative, clean, green battery metal tech with VUL.

Clean, green, battery metal tech is liked by Europe and liked by the market - VUL is still up by 3,185% from our Initial entry and rising the last 9 months.

We think ION fits the same theme.

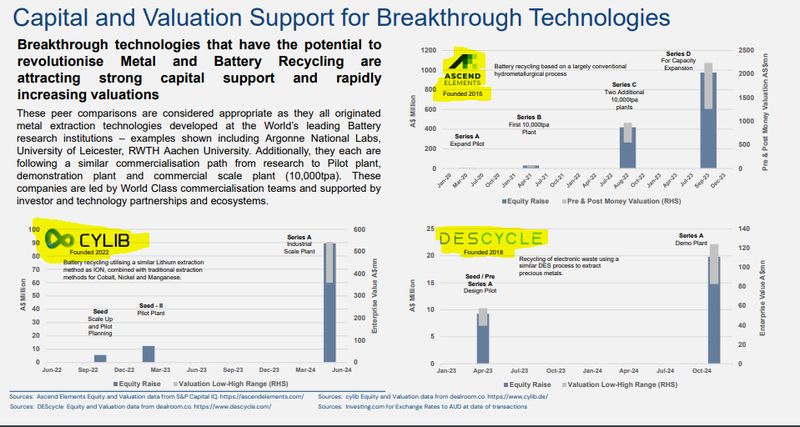

A few private battery recycling companies have been attracting large amounts of capital and large valuations.

Plus the small end of the ASX market looks like it is ready to run again in 2025.

There are still some great stocks out there that have delivered significant progress...

But share prices are low and progress has not been rewarded by the market due to the tough conditions of the last two years.

ION announced lots of progress over the last 12 months but the share price has remained low.

This year we have generally had a pretty good run with our new Investments.

Some highlights include these high points from our Initial Entry Price:

- MTH - 715%

- SS1 - 583%

- AL3 - 420%

- EIQ - 110%

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. These products, like all other financial products, are subject to market forces and unpredictable events that may adversely affect future performance.

This year we have focused on “later stage” companies that we think are undervalued.

And we have had some great results in the technology space too.

(We have only done a handful of technology companies over the last few years).

ION’s technology has already been proven to work at lab scale and bench scale.

(now the company has pilot plant planned in Europe)

...and following a $6M capital raise it is well funded to build the pilot plant, which is expected to be in operation next year.

Electric Vehicles are meant to be good for the environment?

Right?

Global EV growth is creating millions of tons of end-of-life batteries.

“Black mass” is the name given to shredded old batteries.

(Not to be confused with the Johnny Depp gangster movie or the Boston thrash metal band of the same name).

Black mass needs to be recycled.

In the coming years, more and more waves of old EVs will need to have their batteries recycled.

Meaning huge amounts of black mass.

About $100B worth driven by 11M tonnes per annum of black mass.

Today will cover why we Invested in ION, share our Investment Memo which covers in detail:

- What ION do

- The macro theme for ION

- Our ION Big Bet

- What we want to see ION achieve

- Why we are Invested in ION

- The key risks to our Investment Thesis

- Our Investment Plan

Let’s start with our reasons for Investing in ION.

The 12 reasons we Invested in ION

1. Solving a current and growing problem.

Electric vehicle growth is creating millions of tons of end-of-life batteries. +80% of battery recycling occurs in Asia. Europe and the USA are already struggling to acquire critical metals and they want to stop exporting their recyclable batteries (and precious battery metals) back to Asia ASAP.

2. Cleaner, greener, cheaper battery recycling process.

ION’s recycling tech uses non-toxic, typically biodegradable Deep Eutectic Solvent (DES). Conventional recycling technologies are much more energy and acid intensive. This means ION’s tech has the potential to be cheaper and more environmentally friendly.

3. Technology proven in large lab trials, now for a Pilot Plant.

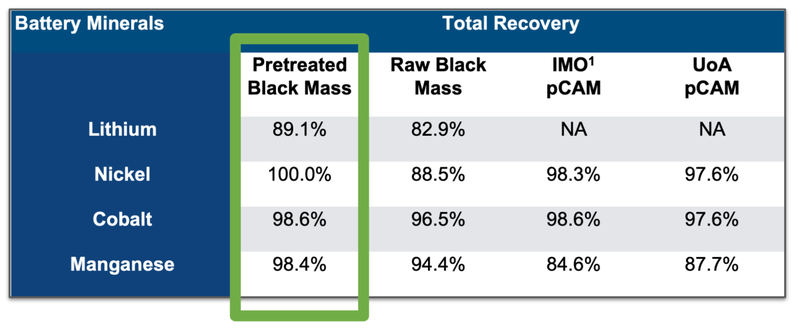

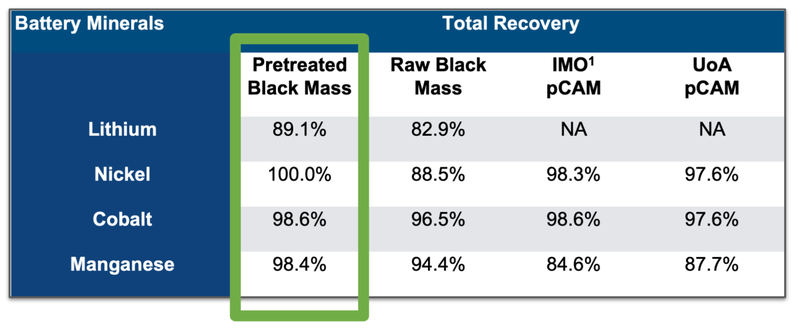

ION’s tech has been de-risked in large lab trials with recoveries from pre-treated black mass of 89.1% lithium, 100% nickel, 98.6% cobalt and 98.4% manganese.

The company has published a PFS for a commercial scale 10,000 tonnes per annum plant. ION expects to have a smaller pilot plant operational in 2025 and work towards a commercial scale plant after that.

4. ION’s “Dream Team” that have worked in chemical processing across technology scale up, capital markets and commercial execution.

- Ebbe Dommisse (CEO): Worked as COO of Circa Group when it was a biomass waste recycling startup through to commercialisation. IPO’d on Norway’s stock exchange at a market cap of €194M.

- NEW ADDITION: Lewis Utting (Commercial Director): Former MD of SciDev (wastewater treatment), While Lewis was MD the stock went from 6.5c to $1.

- NEW ADDITION: Hugo Schumann (Non-Executive Director): Former CFO of Jetti Resources copper extraction technology. Hugo delivered the Series C ($50M) and Series D ($160M) rounds for the company which was last valued at $2.5BN in 2022. Jetti was backed by top industry investors like Freeport, BHP, Mitsubishi and Blackrock. Hugo also established the London office of the Apollo Group, a global natural resources VC firm.

5. Big money is backing recycling tech.

We have seen a few big deals for recycling technology companies in the last 12 months:

- Ascend Elements raised US$524M and also secured a $480M grant from the US Department of Energy (September 2023).

- Clyib recently raised €55M in what was the biggest recycling tech deal in the EU. The company had only been operational for 2 years before that deal... (May 2024).

- Descyle also raised €12M with backing from some high profile EU venture funds (November 2024).

6. Bottom of cycle pick-up in a strong macro thematic for the future.

Battery metals prices have come off from the 2021-2022 boom years for a number of reasons.

We see this as a counter-cyclical Investment with a relatively cheap entry point as a bet on battery metals prices running again. We expect to see demand for commercially viable recycling technology increase as battery metals prices increase.

7. The EU targets recycling and moves to ban black mass export to China.

The EU has legislated a goal that 15% of critical raw materials consumption comes from recycled content each year. The EU is making moves to classify black mass as a hazardous material in a move to limit China’s ability to import it. This could improve ION’s ability to source feedstock with Europe without being undercut by Chinese competition.

8. ION has joined a battery recycling value chain consortium in the EU.

ION has key industry partnerships within the EU including universities and industry groups. This will set the foundation for critical relationships that ION will need to build to (1) secure a reliable supply of feedstock (black mass) for its processing plant and (2) support with off-take agreements.

9. Tightly held stock and a small valuation, EV of just $7M.

Post money the company will have a cash balance of ~$9M and an enterprise value of ~$7M. The two biggest holders together own close to 40% of the company. Per the last annual report, more than 66% of the stock was held by top 20 shareholders. The largest shareholders appear to hold for the long term, and have supported past cap raises and the most recent raise. Sticky, large, supportive long term holders are very important for a small stock to succeed.

10. VUL success with innovative, clean European battery metals and tech story.

We have seen creative, clean, green tech solutions in battery metals supply work very well with our best ever Investment Vulcan Energy Resources. VUL is still up by over ~30x from our Initial Entry Price and has been rising over the last few months. The EU likes clean battery tech stories and it seems the market does too.

11. Innovation pipeline - more types of recycling tech for different critical metals.

ION has a strategic partnership with the University of Adelaide. ION will get first look at any new technologies developed under a $5M grant by the Australian Research Council which is overseen by the two professors that developed ION’s current DES recycling technology.

12. $100B battery recycling market by 2040.

By 2040 the volume of “end of life” battery projects is expected to generate 11M tonnes of black mass every year. This represents $100BN in recoverable value if it is able to be efficiently recycled. This resolves the “feedstock” issue for both ION and Europe to deliver a battery metals industry.

Our full ION Investment Memo is at the end of this note, including objectives we want to see ION achieve, risks we have identified and accepted and our Investment plan.

Our ION Big Bet:

“ION re-rates to a +$150M market cap on successful large-scale production of commercial quantities of battery materials through its recycling process and/or by securing important partnerships in the recycling industry.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our ION Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.:

ION solving a current and growing problem

Europe already struggles to get enough critical metals for its battery building industry.

+80% of black mass processing (recycling) occurs in Asia.

After struggling to get the battery metals supply to build their batteries, EU now has to export them back to Asia to be recycled - this is very inefficient.

Europe has just moved to limit the export of black mass to China.

(and all the precious critical metals inside it)

(Source)

Although it's not an outright export ban, the EU has signaled that it wants to keep as much of the black mass feedstock within its borders.

From 2030, batteries will need to contain a minimum recycled content of 12% for cobalt, 4% for lithium, 4% for nickel. (Source)

While sentiment for battery metals has been in a low patch, we think that ION as a technology play is the exact kind of counter-cyclical investment that we like to make.

(Just like when we picked silver at the start of this year when the market didn't like silver, or Invested in VUL while lithium was unloved in 2019).

ION’s technology could provide an alternative for Europe - with an elegant solution that suits all parties.

One major advantage here is speed.

Discovering and getting new mines built is hard to do and can take up to 14 years in the best of scenarios.

Europe doesn’t have many critical mineral reserves and resources within its borders, so it needs to get creative.

We have seen creative, clean green solutions in battery metals supply work very well with our best ever Investment Vulcan Energy Resources.

Vulcan did Zero Carbon lithium AND geothermal energy extraction from underground brines.

It raised huge sums of money off the back of a string of offtake agreements.

The EU provided funding and the stock market really liked it. VUL is still up by over 30X from our Initial Entry Price of 20c.

And now we think that Europe will turn to battery metal recycling as another source of critical metals.

While also avoiding losing the critical metals they already have inside their batteries.

Our new Investment has a patented battery recycling process out of the University of Adelaide, that is cheaper and greener than conventional recycling technologies.

Its technology uses Deep Eutectic Solvents - or DES for short.

DES achieves >89% recovery rates for lithium, nickel, cobalt, and manganese while using non-toxic, biodegradable solvents in a closed-loop process:

When it comes to chemicals processing technology, we think ION has the right team to deliver.

- Ebbe Dommisse (CEO): Was the COO of Circa Group when it was a biomass waste recycling startup through to commercialisation. The company IPO’d on Norway’s stock exchange at a market cap of €194M.

- Lewis Utting (Commercial Director): Former MD of SciDev, a wastewater treatment company. While Lewis was MD the stock went from 6.5c to $1.

- Hugo Schumann (NED): Former CFO of Jetti Resources, a copper processing technology. Hugo delivered the Series C ($50M) and Series D ($160M) funding rounds for the company which was last valued at $2.5BN in 2022.

What is common amongst ION’s executive team is that they have all been a part of growing and commercialising processing/extraction tech.

This is important for ION’s next stage of development.

Hear CEO Ebbe Dommisse talk through the project:

ION is now ready to take its tech to the pilot plant stage - with construction expected to start and finish in 2025 according to the PFS presentation.

Recycling tech that goes out of the lab and into the pilot plant scale is usually where companies can get a big valuation uplift.

In the last ~12 months three private companies working on recycling technology were able to secure big funding deals:

- Ascend Elements raised US$524M and also secured two grants from the US Department of Energy totalling US$480M (September 2023).

- Cylib recently closed a €55M series A round to develop an industrial scale plant (May 2024).

- Descyle also raised €12M in a series A to develop its demonstration plant (November 2024).

Today, ION announced that it had raised $6M at 1.4c to progress its pilot plant.

We just Invested in ION at 1.4c.

At 1.4c (and when the shares are issued) ION will be capped at $16M with ~$9M cash in the bank.

We think that should be more than enough cash for ION to deliver a few major catalysts.

After today’s capital raise ION’s enterprise value is a tiny ~$7M.

So, how does ION’s technology work?

We are Investing in ION because its technology is different to other recycling technologies in the market.

Most battery metals recycling technologies are some form of a pyrometallurgical process OR a hydrometallurgical process:

- Pyromet - where things are heated to extremely high temperatures using heaps of energy. Energy that can be expensive and depending on the location of the plant, not very environmentally friendly.

- Hydromet - where acids/solvents are applied to treat waste. Sometimes these acids/solvents can be environmentally damaging/toxic.

ION’s tech is a form of hydromet which uses “Deep Eutectic Solvents (DES)” together with “benign organic solvents”.

The combination means ION’s approach uses solvents that are non-toxic and oftentimes biodegradable.

This chemical approach should be a lot more cost effective and have lower energy requirements compared to existing recycling methods.

So far, ION has taken its tech and shown that it works on a large lab scale and shown the ability to recover:

- 89.1% of lithium (with potential to improve this...)

- 100% of nickel

- 98.6% of cobalt

- 98.4% of manganese

Now ION will move through to the “scale up” phase where it will need to prove that its technology works at scale.

If it is able to de-risk the scale up of its technology it could be a significant re-rate for the company.

It’s one thing to produce these results in the lab, now it needs to prove it at scale.

We like ION’s share register

We think that if ION is able to deliver material news then the company’s cap structure is set up to support a share price re-rate.

ION’s top two shareholders are Strata Investment Holdings with 18.8% and Ilwella Pty Ltd with 15%.

Illwella is the office of the billionaire Flanery Family.

Both shareholders have been supporting the company in every cap raise for years and have maintained their % ownership over that time.

(a good sign that they are sticky).

Given the market we are in where most companies need to raise cash at bigger and bigger discounts, having two big shareholders who are willing to pick up a big chunk of any cap raise is always good for a small company to have.

This makes it much easier for the company to raise cash and can also mean the discounts aren't as large...

Case in point is the current raise.

The company raised at 1.4c per share - a premium to its last traded price.

In the last annual report it showed that the top 20 held ~66.4% of the company.

Why do we care about all this?

Because the cap structure and quality of shareholders of a company can sometimes make or break its share price performance.

If a company is publishing great newsflow, but the top 20 shareholders are all waiting to sell into good news, then all of the company’s progress can be met with no valuation re-rate.

Instead a register just churns and the company’s valuation remains low until someone decides to either take the company private for cheap OR the company can start putting out good newsflow again.

This is important for us investing in small cap companies.

If the top holders are in it for the long run to see the technology get developed they will usually hold onto a sizable position and new buyers will be forced to pay higher prices for shares.

This gives the stock the ability to re-rate and the company to raise money at a higher price without diluting the existing shareholders as much.

It's hard to know for sure what happens when there is liquidity, BUT we liked that ION has two shareholders who are backing the company in a big way.

Our Iondrive (ASX:ION) Investment Memo

Memo Opened: 3 December 2024

Shares Held: 26,785,000

What does ION do?

Iondrive (ASX:ION) is a battery recycling technology company.

ION’s technology takes black mass (shredded used batteries) and recovers battery grade lithium, nickel, manganese and cobalt.

What is the macro theme behind ION?

There is a huge wave of EV batteries coming to the end of their lives.

Millions of tonnes of shredded batteries (black mass) need to be recycled, particularly in the EU which exports its black mass to Asia.

The EU is looking to ban exports of black mass.

Battery recycling companies in the EU could solve this problem.

It’s a market worth about $100B worth driven by 11M tpa of black mass.

Our ION Big Bet:

“ION re-rates to a +$150M market cap on successful large-scale production of commercial quantities of battery materials through its recycling process and/or by securing important partnerships in the recycling industry.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our ION Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

Why did we Invest in ION?

- Solving a current and growing problem.

- Cleaner, greener, cheaper battery recycling process.

- Technology proven in large lab trials, now for a Pilot Plant.

- ION’s “Dream Team” that have worked in chemical processing across technology scale up, capital markets and commercial execution.

- Big money is backing recycling tech.

- Bottom of cycle pick-up in a strong macro thematic for the future.

- The EU targets recycling and moves to ban black mass export to China.

- ION has joined a battery recycling value chain consortium in the EU.

- Tightly held stock and a small valuation, EV of just $7M.

- VUL success with innovative, clean European battery metals and tech story.

- Innovation pipeline - more types of recycling tech for different critical metals.

- $100B battery recycling market by 2040.

What do we expect the ION to deliver?

Objective #1: Publish economics on recycling plant projects.

ION is currently undertaking an economic study to evaluate the NPV and IRR of its recycling plant. This will provide us with a much better picture of the potential economic upside of the project.

Milestone

🔄 Economic modelling of Net Present Values

Objective #2: Design and build pilot plant

We want to see ION build its pilot plant. This pilot plant will set the stage for ION to better develop its technology, and provide potential samples to offtake customers.

Milestones

🔲 Complete design of pilot plant

🔲 Lock in EPCM contract for the build

🔲 Start construction on pilot plant

🔲 Complete pilot plant construction

Objective #3: Successful commissioning of pilot plant

Once the plant is constructed we want to see if ION’s technology can repeat the successful recoveries of critical materials at a larger scale.

Milestones

🔲 Pilot plant commissioned

🔲 First recovery results from pilot plant

🔲 Second recovery results from pilot plant

🔲 Third recovery results from pilot plant

Objective #4: Corporate deals to secure business model

While the pilot plant is being constructed we want to see ION secure corporate deals, offtake agreements, black mass supply, industry partnerships and funding/financing.

Milestones

🔲 Industry deal 1

🔲 Industry deal 2

🔲 Industry deal 3

🔲 Industry deal 4

🔲 Industry deal 5

What could go wrong?

Funding and dilution risk

ION is a pre-revenue small cap company. This means that ION may need to raise funds in the future via capital raises that may incur dilution to shareholders.

Scale up / technology risk

There is no guarantee that the Pilot Plant is able to replicate the results from the large lab study. Also “feedstock reliability” both in terms of supply and consistency of material is a big risk for ION to scale up its operations.

Commercial/Sales risk

Product qualification for batteries with OEMs takes a long time. There is no guarantee that ION can sell its product through offtake agreements or that it can produce something that is commercial and on spec for its customers. If offtakes are delayed it can impact the ability of ION to secure further financing for a commercial scale plant.

Regulatory risk

ION wants to build its first plant in Europe to take advantage of the Critical Raw Materials act and potential export bans of Black Mass. If these regulatory tailwinds are delayed, don’t materialise or are not enforced, then it may negate some of the regulatory edge that ION has in the market. The same goes for the IRA in the US.

Market risk

There is always a possibility that the broader market sells off dragging ION shares with it. Or alternatively there could be sector specific pain ahead for the tech industry, hurting companies like ION.

What is our Investment Plan?

We plan to hold a position in ION for the next 3 years (and beyond) as it progresses its pilot plant and recycling technology.

We eventually may look to take some profits by selling up to ~20% of our holding (in line with our holding policy and escrow conditions) if the share price materially rerates on the company successfully delivering on the key objectives listed above.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.